Actual HRA offered by the employer = Rs.(Actual rent paid) – (10% of the basic salary) = Rs.The amount of tax deduction that can be claimed will be the least of the following: The following table shows the salary structure for Mr. Now, let us understand how much tax deduction he can claim on the basis of this allowance.

A, who lives in a rented house, works as a salaried employee in Delhi. NOTE: Salary refers to the sum of basic salary, dearness allowance (DA) and any other commissions, if applicable for the purpose of HRA calculation.

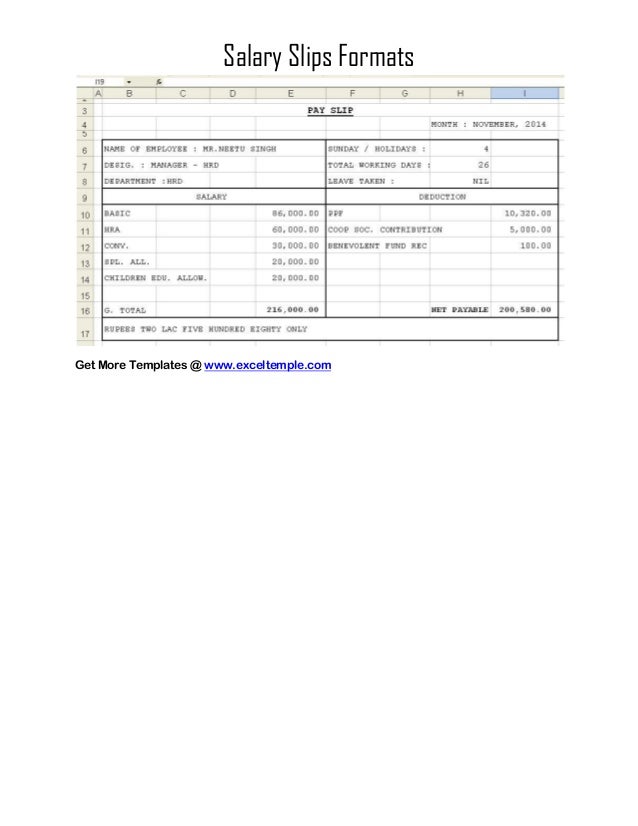

Let us understand the eligibility criteria to claim HRA deduction and its calculation in the following sections. HRA not only helps you manage the expenses incurred on a rented house, but also helps you save on your total tax outgo. It refers to the amount paid by an employer to his/her employee to meet the cost of living in a rented accommodation. The full form of HRA is House Rent Allowance, which often forms a key taxable component of a salary slip.

0 kommentar(er)

0 kommentar(er)